Tax Deductions

Tax Deduction for Donations

On June 12, 2013, HOPE International Kaihatsu Kikou (hereafter HOPE-JP) became a Nintei NPO in Japan. This means that donations to HOPE-JP are now tax-deductible for corporate tax, personal income tax, personal residential tax and inheritance tax.

Donations from Individuals

① Income Tax (Shotoku-zei)

To be eligible for this tax deduction, donations made to HOPE-JP need to be filed at the time of the income tax declaration. (This cannot be done at the year-end adjustment for employees.) There are two different methods of deduction for individuals to choose from: deduction from the income tax itself or deduction from income.

- Deduction from income tax itself

Use the formula below

(Donation ※1 - 2,000 yen) × 40% = Tax deduction for donations ※2

※1 Maximum 40% of gross income

※2 Maximum 25% of the Income Tax - Deduction from Income

Use the formula below to calculate the amount to be deducted from your income:

Donation ※ - 2,000 yen = Deductible value for donation

※ Maximum 40% of gross income

For more details, please check with your local tax office (Zeimusho), the National Tax Agency website (Japanese only), etc

② Personal Residential Tax (Jumin-zei)

A residential tax deduction can only be given in by local ward, village, city,and/or prefecture that has appointed HOPE-JP donations as applicable for its tax deductions.

Please check with your local municipality for more information about appointed organizations and necessary procedures.

③ Inheritance Tax (Sozoku-zei)

When part or all of one's inheritance is donated, the donated portion will be exempt from the inheritance tax. To be eligible for this tax deduction, the donation must be made before the deadline for filing the inheritance tax forms. Please consult with your local tax office for more information.

※ When filing for tax deduction, please consult with your nearest tax office.

※ HOPE-JP is unable to give advice on these matters.

※ When filing for tax deduction, receipt(s) of donation from HOPE-JP is required.

Corporate Donations

For donations from companies to HOPE-JP, now a Nintei NPO, an additional threshold is given for the maximum deductible amount to be treated as loss.

(amount of capital x 0.375% + amount of income x 6.25%) ÷ 2

For more details about corporate tax deductions, please check with your accountant, local tax office, the National Tax Agency

website (Japanese only), etc.

※ The maximum values vary, depending on a company’s capital and income. Please check with your local tax office, an accountant or specialists for more details.

※ HOPE-JP is unable to give advice on these matters.

※ When filing for tax deduction, receipt(s) of donation from HOPE-JP is required.

Donation Receipts from HOPE-JP

- In principle, receipts will be issued for each donation received. However, for Partnerships (fixed monthly donations), receipts for all of the donations received during the prior year (January to December) will be sent once a year in January.

- Receipts will not be issued when HOPE-JP is informed a receipt is unnecessary, “No Receipt” is selected on the online donation form and the donor’s address is unknown

- In the event that a receipt becomes necessary, please contact HOPE-JP by Email (info@hope.or.jp) or fax.

- The donor’s registered address is required for issuing a receipt valid for tax deductions. If there is a change in address, please contact HOPE-JP by E-mail or fax.

- The name on the donation receipt will be the same as that used for the bank transfer, postal transfer, credit card payment, or Robot Payment.

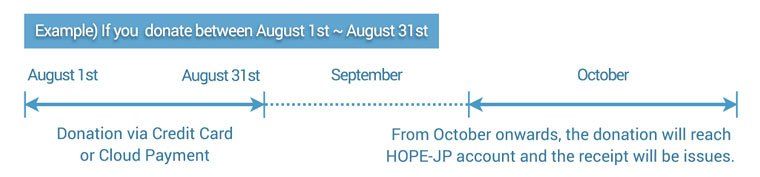

- Receipts will be dated according to the date money is received by HOPE-JP. For those who wish to pay via credit card or Robot Payment, please refer to the chart below.

- The receipt date cannot be changed.

- Receipts will not be re-issued upon loss. Please keep it with care until your tax declaration.

Receipt Issuing Time Line

The issuing cycle for donations by Credit Card and Robot Payment differ from Bank and Postal Transfers.

Credit Card, Robot Payment

| Timeline for issuing receipt | ±2~3 months after the transaction date ※ In the case of partnership, receipts for all of the previous year’s donations will be sent in January. ※ Receipts for donations made in or after November may be dated and issued in the following year. |

| Name on Receipt | Credit Card holder's name |

| Receipt Date | Date that the donation reached HOPE-JP's account ※ Note: The receipt date is different from the transaction date. |

Bank Transfer, Postal Transfer

| Timeline for issuing receipt | ±2~3 weeks after the transfer ※ In the case of partnership, receipts for all of the previous year’s donations will be sent in January |

| Name on Receipt | Name on the transfer |

| Receipt Date | Date that the donation reached HOPE-JP's account ※ Note: The receipt date may be different from the transfer date. |

WAYS TO GIVE

OUR PROJECTS

-

Cambodia

CambodiaOver 500 wells installed and 15,000 people lifted out of poverty...

-

Ethiopia

EthiopiaSince 2001, HOPE-JP water supply systems in 13 villages have brought 27,000 people clean water...

-

The Philippines

PhilippinesHOPE-JP has been working in the Philippines since 2003, helping families and communities in need become self-reliant...

-

India

IndiaIndia Families lifted out of poverty and living self-reliantly...

Japan

Although primarily focused on projects in lower income countries, HOPE-JP has supported several projects in the Tohoku Region

NINTEI NPO

Established in Japan in 2001, HOPE International Development Agency Japan is a Nintei NPO, certified with tax deductible status as of June 2013.

CONTACT US

2F Kamiya Bldg.,

1-16-2 Sakae, Naka-ku, Nagoya

〒460-0008

1-16-2 Sakae, Naka-ku, Nagoya

〒460-0008

Tel: 052-204-0530

Fax: 052-204-0531

Email: info@hope.or.jp

© 2024

All Rights Reserved | HOPE_JP